The AI pricing hullabaloo

It's a good weekend to deflate the hype around AI disrupting all pricing and understand where seat-based vs value-based models are working in AI SaaS.

It’s February 2027. A Zoom agent attends a daily standup meeting on your behalf while you take a PTO day. It updates the team on your schedule and priorities for the week. The meeting concludes and Zoom charges your company $1.99c for a successful agentic meeting outcome.

Is this our future? The answer is left as an exercise for the reader.

Despite the near hysteria amongst tech pundits about pricing for successful work and AI disrupting all SaaS pricing, the reality is that most high-growth AI startups are deploying seat and consumption-based pricing - just like it’s 2020. The latter lever is specifically important for inference-hungry power users who reliably turn their consumption into revenue.1

These startups package this pricing in a dozen different ways - credits, tasks, workflow steps, skills, video minutes, GPU hours, translated files, etc.—but in the end, it’s seats and/or consumption, typically of inference units. Good packaging aligns with the customers' unit of value, but treating them as uniquely different pricing models just adds artificial complexity to a simple phenomenon.

Artificial complexity is my least favorite kind of complexity.

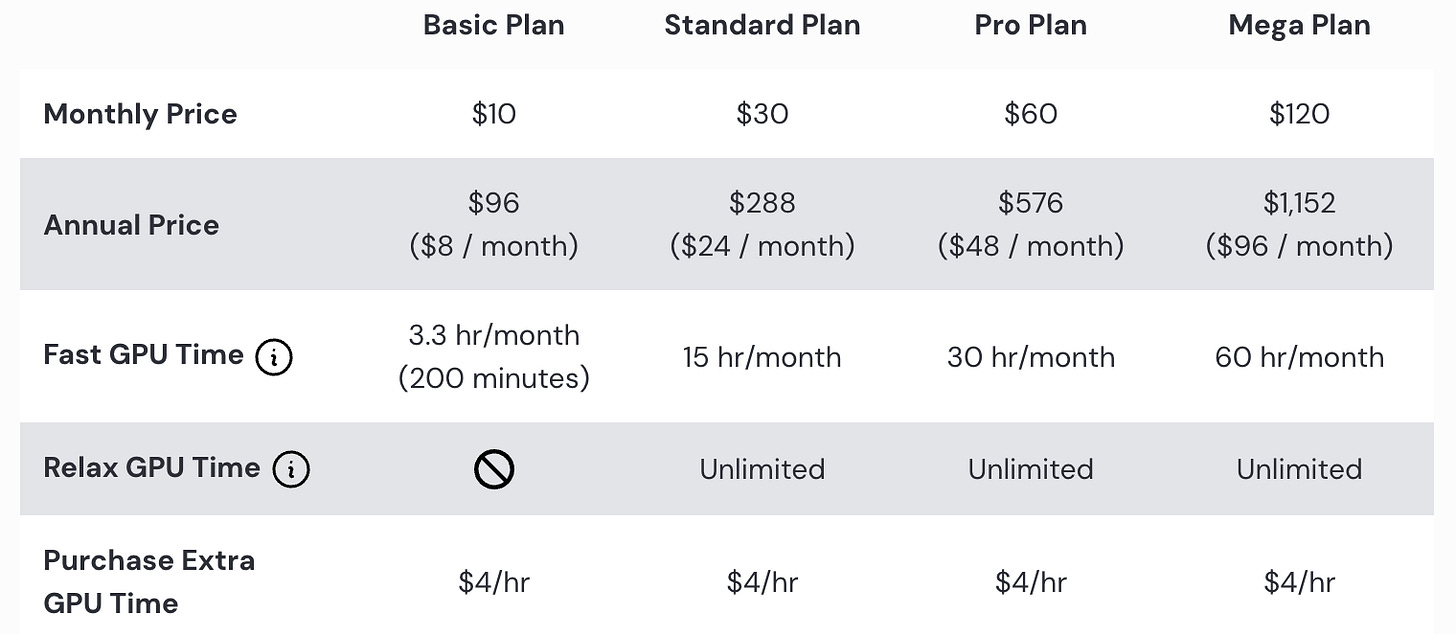

Here’s Midjourney’s pricing page for instance. They have monthly prices based on how much discounted GPU time you want to buy upfront with extra hours available on demand.

They are the perfect example of a disruptive product where AI is doing the work rather than offering a tool. In fact, there is barely any “tooling” in Midjourney, most of their users happily text Discord to create and iterate on images. ChatGPT pricing is very similar if less transparently tied to GPU time. You have more access to inference-hungry functionality (like Operator, Deep Research, o1-pro) in higher tiers of seat-based pricing - a blend of seats and consumption bundled together for simplicity. Simplicity can drive adoption, you don’t need a disruptive pricing model to be an AI company.

Where outcome-based pricing works

This isn’t a bearish take on outcome-based pricing. I am simply tired of it being treated as a disruptive panacea by pundits which makes CEOs everywhere waste time fretting whether they are being cool enough instead of simply doing what’s best for their customers.

So far, the only two solid examples of novel outcome-based pricing in AI are customer support and revenue loss prevention. Let’s take a closer look at why.

Companies like Intercom and Sierra charge their customers per resolved L1 support ticket while Chargeflow (e-commerce chargebacks) and SmarterDX (clinical diagnostic documentation) charge based on successfully capturing previously lost revenue for their customers.

These are very different use cases and customer profiles, but they have a few things in common that make them a good fit for outcome-based pricing:

An independent third party defines success. In customer support, this is the buyer with complaints/questions. For chargebacks, this is the payment processor looking for evidence to resolve the dispute. In clinical documentation and compliance, it is the health insurance company looking for evidence to support the billing. They decide if the outcome is a failure or a success - not the AI vendor or their client.

The economics of the outcome are relatively well understood. There is no hidden alpha from creative human effort in any one interaction, unlike say, an enterprise sales process or a strong product designer. What’s required is disciplined execution at scale.

In most cases, this work was already being outsourced to third parties. The BPO/contact centre industry is an obvious and massive target market for AI. There are well-defined SLAs (L1-L4 in support) and well-known correlations between consumption and positive outcomes for customers which the AI SaaS company can rely on when developing its revenue model.

Other industries for outcome-based pricing that meet these criteria include recruiting contractors/staffing agencies, bidding for government contracts, personal injury law, etc. Outcome-based pricing is the norm in these industries and AI tools that sell into them are not inventing novel models but aligning with customer expectations.

However, these three criteria are not met for most seat-based SaaS. Whether it’s design, sales, marketing, engineering, HR, finance, etc, there is often no independent definition of a successful outcome that can’t be gamed and hence can be trusted. There can be lots of upside from creative work that goes beyond their job definition. That’s why so many people are compensated with fixed salaries and equity, not just $/hour for their work.

But what about disappearing seats, you ask? If there were fewer and fewer human employees to sell your kind of software to, why would you want to price per seat? Isn’t AI deflationary for seat-based pricing?

That’s an interesting thought experiment.

Elastic and inelastic demand

There are two kinds of demand - elastic and inelastic. It’s now clear that demand for AI at every layer - compute, models, applications - is elastic. Consumption goes up significantly with decreases in cost. This is why everyone was googling Jevon’s paradox when Deepseek launched its open-source reasoning model R1 at <5% of the cost of openAI’s o1.

If you believe your AI application has elastic demand, it makes sense to offer consumption-based pricing with a low price per unit as a strategy to drive up adoption in your customer base. A great way to test this is a free beta period.

However, if there is a low natural ceiling to how much value your customer can generate from your AI application, you might be better off sticking to seat-based pricing for them instead of diluting the unit price of your software. Your company’s expansion strategy will then require shipping new solutions to the same customer over time.

I would argue that even for the same agentic software, demand could be elastic for one customer segment but inelastic for another. For instance, you might scale up the usage of a marketing agent aggressively to sell ERP software to HVAC businesses. However, if you are an HVAC business offering services in one specific city, there is a low natural limit to your consumption of a marketing agent. Your customer’s marginal cost of growth changes their demand profile.

In addition, I would argue that the demand for some kinds of labour is inelastic. There has been no special decline in demand for experienced software developers in Silicon Valley no matter how cheap code generation gets or how expensive the developer salaries get. The same seems true for many product, GTM and finance roles. Why is that?

The company-building arms race

A unique aspect of software markets is that they are winner-takes-most. It’s not enough to grow efficiently, you need to capture the most possible share of the best market your products can serve.

Hence, in a growing and competitive market, you invest resources not just to operate the company efficiently but to win more customers than your competitors. In this way, they resemble countries locked in an arms race for resources.

AI is making SaaS a higher-growth, more competitive market with 10X expansion potential. If you are satisfied with automating GTM functions to reduce your team headcount, you might find that your competitor is keeping their staff to invest in new creative strategies that help them win over your customers.

The fact that small teams like Cursor exist is not evidence to the contrary, they will need to invest a lot to keep the customers they have acquired as the market heats up. Not enough time has passed for us to start celebrating the era of solo employee companies building a generational megacap business. Even though Zuck would love it.2

All this to say, if you are serving skilled professionals for whom there is inelastic demand in the market, your seats aren’t going anywhere. Of course, you are vulnerable at the negotiation table if your seat utilization is below 100%, but that’s been true long before the ChatGPT moment. Dave Kellog writes well about this in his post on the impact of value-based pricing on ARR as a SaaS metric.

So what happens to realized price per seat?

As the leader of an incumbent SaaS business, it’s quite simple. You want to be ready to replace your lost seats with agentic revenue rather than let a startup take that wallet share from you. You have all the advantages of data and distribution, but it’s still hard to build for an imagined future. After all, agents don’t work reliably for most end-to-end jobs yet. They are like eager interns at a bakery who have read everything about baking and have a 95th percentile Elo score on the baking benchmark but have never baked a cake. Most customers don’t replace someone reliable with something that kind of works, sometimes.

The bull case here is that the agentic revenue could point to a much bigger market opportunity than your historical seat-based business. The worst thing to do would be to shore up your seat-based revenue at the expense of capturing the bigger market with adoption-friendly pricing.

If you are a startup founder, your outlook should be very different from that of a SaaS incumbent. You want to build those seat-replacing labour products for clients who love new technology and will settle for something less reliable than the status quo because it’s too expensive. How you price your product for those customers might still be seat-based with some consumption model for power users to match your inference cost profile. If you provide extraordinary value - your price per seat can match that. Consider Autodesk’s 3D software VRED which retails at $1,899 per seat/month or the $500M and growing business OpenAI has built with ChatGPT Pro at $200 per seat/month.

I bet Zoom will still be a seat-based business in Feb 2027 - just more expensive if I want that PTO agent feature.

AI power users are also notoriously expensive to serve. Agentic reasoning and video generation can be 10,000 times more expensive per query than the average GPT API call.

Checkout this excellent Baseten Series C promo video for the reference.

Love it!!

"These startups package this pricing in a dozen different ways... uniquely different pricing models just adds artificial complexity to a simple phenomenon.

Artificial complexity is my least favorite kind of complexity."

Fantastic analysis! Loved the approach of inelastic and elastic demand. SaaS or seats based pricing has a basic assumption behind it that an additional seat has a marginal cost of near zero - while this is not true for GenAI where marginal cost increases with usage. How does that factor into your thinking? Is that why you argue for a fixed seat price plus a consumption element for heavy users? I love how this topic is so front and center right now - pricing and packaging is exciting stuff. How would you say should companies think about iterating and testing their pricing and packaging models?