note: a few weeks after this this post was published, ServiceNow announced the acquisition of AI startup MoveWorks for $2.9B to address the challenges surfaced below.

Started as a cloud-first help desk in 2004 by then 50 year old Fred Luddy, ServiceNow is the second largest SaaS company in the world. It dominates IT services with a whopping market cap of $235B, 83% GM and grew ARR 23% last year. Its metrics are the envy of enterprise software CEOs.1 Surprisingly, it’s not that that well known a company in silicon valley.

ServiceNow reported its fourth quarter 2024 earnings yesterday with EPS above target, revenue pretty much on the ball and a “150% qoq growth in deals for our AI product”.

The market’s not buying it. Lip service to AI is not enough to convince anyone you have a vision, especially when your board also authorizes $3B (of your $3.5B in cash) for share repurchases. ServiceNow is quietly painting a target on its back and the AI agent startups will come for it.

In an earlier post titled, “Will AI agents eat SaaS?”, I made the case that SaaS startups still have a lot of structural advantages and will be the best model to bring AI agents to market. However, not all SaaS incumbents are set up to win. Here’s why I think ServiceNow is a great company for ambitious AI founders to go after.

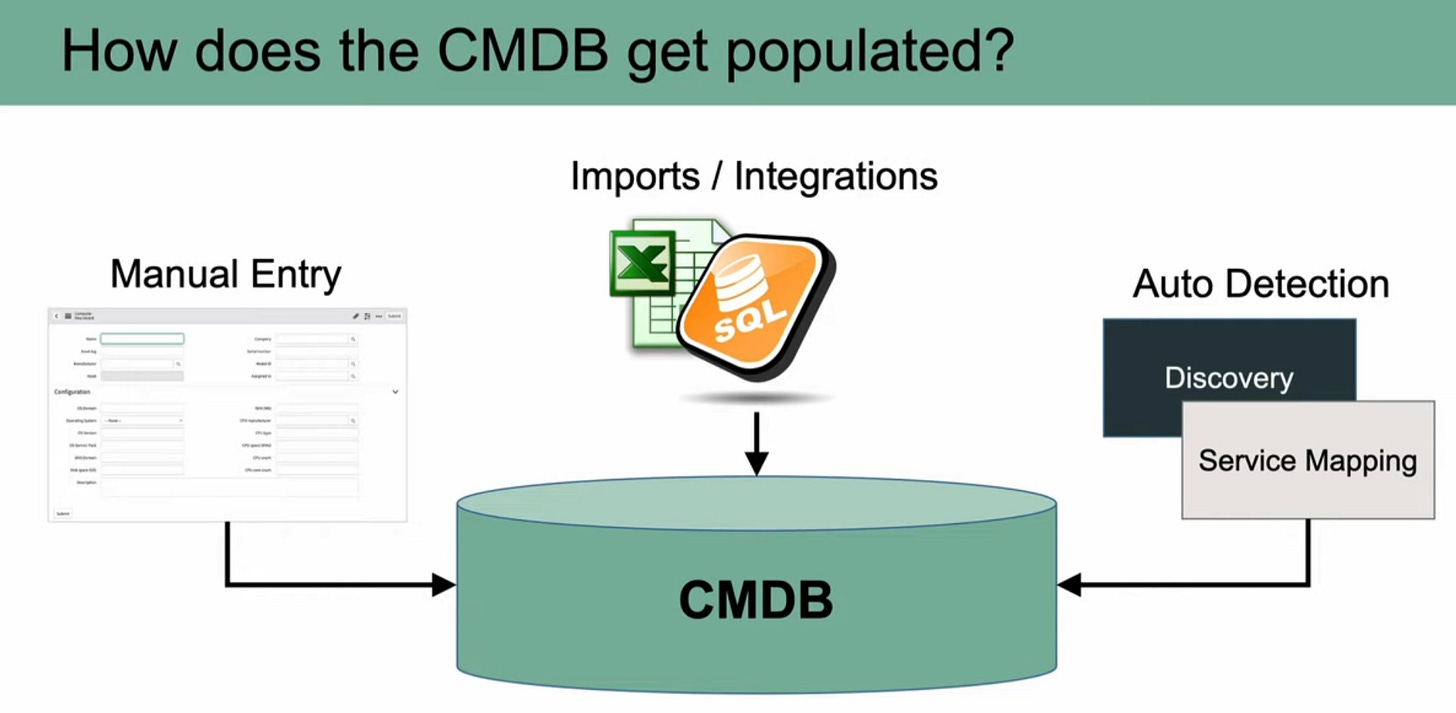

ServiceNow has built an incredibly sticky enterprise business with a 97% renewal rate across 8000+ organizations. They have done this with an exceptional channel sales strategy on top of their cloud-native CMDB (configuration management database) - technology that has been used since the 1980s to track IT assets, dependencies and configurations. The company modernized it, launching Service Graph, its proprietary version of CMDB in late 2019.

They also used their sticky enterprise presence to expand beyond ITSM (IT Services management) into customer service, HR, sec ops and even some RPA-style finance workflow automation. Since then, ServiceNow has grown annual revenue from $3.5B to nearly $11B.

All this to say, they are not idiots. They know the current status quo - manual workflows and CMDB updates - are time-consuming, often resulting in poor data. They acquired an AI research team (Element) in 2020 to add ML talent to their product org. They have consistently shipped incremental improvements to their point-and-click workflows to save end users time. However, similar to Google and Search - they face a dilemma. All their moats, the strengths they have built their $200B+ business on, are going to prevent them from winning the AI war. Here’s why:

Commoditizing the CMDB

The core workflow of populating and updating a generic CMDB for enterprise organizations (see image below) is a great use case for agents that can read logs and perform incident resolution automatically. Imagine your IT incidents being resolved before a human being files a ticket trying to describe what they think has gone wrong. While open-source CMDB solutions are already available, there is way more demand for a turnkey solution that an agentic service could fulfill.

Disrupting Channel Sales

There are over 2,200 organizations that serve as channel and implementation partners to ServiceNow and influence >90% of its revenue. I suspect that similar to what we are seeing in GTM Tech, a new startup will allow a new breed of lean AI-first, dev-first, IT agency entrepreneurs to rise. ServiceNow can’t ruin their channel relationships by building products that circumvent them.

Low on 3rd party integrations

To compound these woes, ServiceNow isn’t quite a platform play like Salesforce. Many large SaaS companies have been built on Salesforce integrations creating a chicken and egg problem for new startups that want to break through with mid-sized or large customers in the CRM world. ServiceNow does a great job of offering their own pre-built integrations which has allowed them to retain more wallet share. However, it also makes them more open to disruption.

Consumption Pricing

Pure cost centres are the very first to embrace consumption pricing in businesses - especially large companies which have an established data set around how much they utilize a particular solution. This is why AI-native customer support has led the charge as a business use case to embrace outcome-based pricing. This won’t just be a revenue recognition problem for ServiceNow but a fundamental shift in software utilization as companies invest in agentic solutions for IT.

Expansion Vectors

ServiceNow’s expansion areas (hr, finance, customer service, incident management, RPA, etc) are not as closely tied to their CMDB moat as they need to be. These are all areas that high-growth agentic SaaS startups are finding early success with and can move up-market easily in. And for now, they are battling Salesforce for this expansion turf while Atlassian’s JISM solution disrupts their core mid-market offering.

—

In short, this presents a massive opportunity for founders who understand both enterprise IT and agentic LLM-based systems. Granted that’s a venn diagram with little overlap today but it’s a ticking clock for the second-largest SaaS company in the world. I suspect that new startups emerging in this category will be a lot more verticalized than ServiceNow is. The IT infrastructure and services needs of companies are starting to get more specialized over time and this might be a market category that shifts from horizontal to vertical in the 2030s.

If you are building a radical new product for AI IT service agents, drop me a DM.

Check out this fabulous recent podcast interview between Frank Slootman and Fred Luddy on Crucible Moments.

Love this perspective, Sandhya.

At Atomicwork, we are taking on ServiceNow with a full-stack, modern and agentic platform to enable Enterprise IT teams achieve more for their business.

In todays world, IT teams should focus on delivering enterprise productivity not just IT process and support management.

We recently raised $25M from Khosla, Battery, Z47 and Peak XV - https://techcrunch.com/2025/01/28/atomicwork-gets-backing-from-khosla-for-its-ai-alternative-to-old-school-it-software-like-servicenow/

At Plotch.ai, we are building agentic AI workforce infrastructure so that enterprises can build, deploy and monitor their internal digital workforce of ai agents for any use case including IT support, analytics, process monitoring, digital commerce, procurement, accounts payable. We also help enterprises build their custom agents using our infra.